Vancouver, B.C. – TheNewswire – March 15, 2022 Mobio Technologies Inc. (“Mobio” or the “Company”) (TSXV:MBO) is pleased to announce it has entered into a non-binding letter of intent (the “LOI”) dated March 15, 2022, which sets out the proposed basic terms and conditions for the 100% acquisition of Tracksuit Movers Inc. (“TMI”), a full-service moving company franchisor and a 100% acquisition of Elite Window Cleaning Inc. (“Elite”), a window cleaning franchisor through a share exchange (the “Transaction”). The acquisition of TMI and Elite is subject to negotiating and entering into a binding share exchange agreement, approval by disinterested shareholders of Mobio and acceptance of the Transaction by the TSX Venture Exchange (the “Exchange”). The acquisition of TMI will constitute a Non Arm’s Length Transaction and Reverse Takeover of Mobio, as defined in the policies of the TSX Venture Exchange (the “Exchange”).

Information concerning Tracksuit Movers Inc.

Tracksuit Movers Inc. is a company existing under the laws of British Columbia and headquartered in Lenexa, Kansas. Its business consists of franchised residential moving operations across Canada and the United States. As TMI, they own all of the system and related marks, including the mark "You Move Me", and license them for exclusive use and sublicensing in Canada and the United States. TMI currently has 4 franchisee locations in Canada and 15 in the United States. Corporately run locations are operated out of the Cincinnati, Ohio, Phoenix, Arizona, and Toledo, Ohio markets.

The principal shareholders of TMI are Laurie Baggio (a resident of British Columbia), Lance Tracey (a resident of British Columbia), Josh Herron (a resident of USA) and Tyler Staszak (a resident of USA). The acquisition of TMI will not constitute an Arm’s Length Transaction, as defined in the policies of the Exchange as Laurie Baggio and Lance Tracey are also significant shareholders in Mobio and Directors in TMI. Laurie Baggio is also the CEO and a Director of Mobio. This acquisition will require an approval of disinterested shareholders of Mobio.

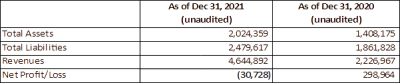

The following sets out selected unaudited financial information for TMI and provided by TMI as at and for the periods set out below:

TMI is in the process of completing its audits. Comprehensive financial information of TMI including audited financial information for the years ended December 31, 2020 and 2021 in addition to unaudited interim financial information for either the three months ended March 31, 2022 and 2021 or three and six months ended June 30, 2022 and 2021 will be included by Mobio in its information circular with respect to the acquisition that will be publicly available on SEDAR and mailed to the shareholders of Mobio after a binding agreement is prepared, finalized and entered into.

“We are excited to join Mobio and Elite on our journey in the homes service industry. You Move Me has been thoughtful and intentional on how we provide support and resources to our growing franchisee base. We believe You Move Me joining this team of entrepreneurs will make a difference in the long-term growth trajectory of You Move Me.” Josh Herron, Co-CEO of TMI.

Information concerning Elite Window Cleaning Inc.

Elite Window Cleaning Inc. is a company existing under the laws of Ontario and headquartered in Kingston, Ontario. It offers professional and affordable window cleaning services. Elite offers a wide variety of window cleaning services from high-rise towers to residential homes. They currently have 6 franchisee locations in Canada and have a corporately run location in Kingston, Ontario.

The principal shareholder of Elite is Chis Stoness (a resident of Ontario). The acquisition of Elite does constitute an Arm’s Length Transaction, as defined in the policies of the Exchange.

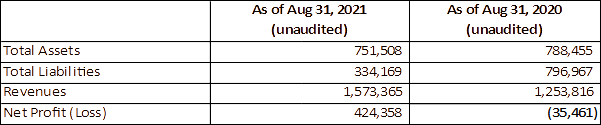

The following sets out selected unaudited financial information for Elite and provided by Elite as at and for the periods set out below:

Comprehensive financial information of Elite including audited financial information for the years ended August 31, 2020 and 2021 in addition to unaudited interim financial information for the three and nine months ended May 31, 2022 and 2021 will be included by Mobio in its information circular with respect to the acquisition that will be publicly available on SEDAR and mailed to the shareholders of Mobio after a binding agreement is prepared, finalized and entered into.

“The opportunity to join Mobio and work alongside like-minded entrepreneurs has presented us with the momentum and collaborative structure to realize our growth plan over the coming five years. By working alongside brands like You Move Me and adopting best practices from parallel home service companies within a single ecosystem, I believe the collaboration will help solidify Mobio within the home services industry.” Chris Stoness, CEO of Elite

Information concerning Mobio Technologies Inc.

Mobio is a publicly traded company on the TSX Venture Exchange, headquartered in Vancouver, BC, and runs Strutta.com Media Inc. Strutta is a social promotions platform that helps marketers bring potential customers from stranger to fan to customer, and Strutta’s Promotions API provides a technology platform that facilitates social media competitions and campaigns for global brands.

Mobio currently has the following securities issued and outstanding: (i) 38,297,546 common shares (each, a “MBO Share”); (ii) 75,000 director options, and 12,500 agent options, each of which is exercisable into one MBO Share at a price of $0.22 per MBO Share; and (iii) 1,666,670 warrants, each of which is exercisable into one MBO Share at a price of $0.30 per MBO Share. There are no other options, warrants or other convertible securities to acquire securities of MBO outstanding. Further information concerning Mobio can be found under Mobio’s profile on SEDAR.

Information Concerning the Proposed Transaction

Mobio, TMI and Elite have entered into the LOI setting out certain terms and conditions pursuant to which the proposed Transaction is expected to be completed. The terms set out in the LOI are non-binding, and the LOI is subject to the parties successfully negotiating and entering into a binding share exchange agreement (the “Definitive Agreement”) in respect of the LOI on such a date as may be agreed to by Mobio, TMI and Elite.

Mobio plans to acquire TMI and Elite by exchanging shares at the following valuations:

TMI $12,000,000 CAD

Elite $2,110,000 CAD

The valuation of TMI was performed by a 3rd party independent valuator. The shareholders of TMI and Elite will be issued shares in Mobio at the market value at closing of the Transaction based upon the valuations above. The exact number of shares to be issued by Mobio will be determined and will be based on the share price on the closing of the Transaction.

Notwithstanding the foregoing, $610,000 CAD of the consideration paid for the shares of Elite will be paid in cash. Concurrently with the acquisition of the TMI and Elite, Mobio will need to complete a private placement equity financing of $3,000,000 to $4,000,000 CAD (the “Concurrent Financing”). The price per share of the Concurrent Financing will be determined and will be based on the share price on the closing of the Transaction. As of the date of this news release, Mobio has not received any funds with respect to the proposed Concurrent Financing.

It is anticipated that $1,000,000 each will be put into TMI and Elite for the dedicated expansion of corporate locations and other franchise operations. The balance is expected to be used to fund working capital and further searches of future acquisition targets.

All non-arm’s length debt of Mobio, approximately $600,000 CAD, is expected be converted to equity at or prior to closing at market value and Mobio upon completion of the acquisition of TMI and Elite and receiving the required regulatory approvals plans to sell its subsidiary Strutta.com Media Inc. (“Strutta”) to a related party.

Mobio plans to conduct additional brand acquisitions in the home services space with a view to developing a synergistic portfolio of brands that drive maximum shareholder value.

“Bringing together strong brand operators like You Move Me and Elite Window Cleaning will create a solid foundation for our future mobile-centric, customer-first vision. We see opportunity in both organic growth of these great businesses and further acquisitions that fulfill our vision.” Laurie Baggio, CEO of Mobio.

Following the completion of the Transaction, it is expected that TMI and Elite will be wholly-owned subsidiaries of Mobio. The final legal structure for the Transaction, however, will be determined after the parties have considered applicable tax, securities and accounting matters.

Certain Mobio securities issued in connection with the Transaction will be subject to the escrow requirements of the Exchange, and hold periods as required by applicable securities laws.

Management and Board of Directors of Resulting Issuer

Upon completion of the Transaction, it is anticipated that there will be no changes to Mobio’s current board of directors and management team.

Josh Herron and Tyler Staszak are expected to be co-CEO’s of TMI.

Josh Herron has been involved in home services since 2008 starting as a general manager of the 1-800-GOT-JUNK?, a franchise in Kansas City. In 2011, he co-founded Easy Moves, LLC which became one of the launch franchise partners for You Move Me, LLC. Starting in 2015, he became a franchise partner in multiple locations of 1-800-GOT-JUNK? He is the co-founder and CEO of Southwind. Since 2007, Tyler Staszak also has an extensive operating history as a Franchise Partner with multiple locations with 1-800-GOT-JUNK? He co-founded Easy Moves, LLC and is also a co-founder of Southwind. Cumulative revenues of Josh’s and Tayler’s franchised operations was in excess of $60,000,000 in 2021. Josh and Tyler also own another home service business in the HVAC space called MVP Air Conditioning Heating and Electric. Prior to owning and running their businesses, Tyler was a software engineer and Josh was a student.

Chris Stoness is expected to be the CEO of Elite. Chris founded Elite in 2012 and has scaled the business from a standalone operation to a franchise system with 7 locations. Prior to launching and building Elite, he was a sound engineer.

Sponsor

Mobio will be seeking a waiver from engaging a sponsor with respect to the proposed Transaction

Finders’ Fees

It is expected that no finders’ fees will be paid in connection with the Transaction and the Concurrent Financing.

Follow-up News Release

Mobio will issue a follow up news release when additional information becomes available with respect to the proposed Transaction and when a Definitive Agreement is prepared, finalized and executed.

Trading in Mobio’s Shares

Trading in Mobio’s common shares on the Exchange has been halted in connection with this announcement. Trading in Mobio’s shares will remain halted pending the review of the proposed Transaction by the Exchange and satisfaction of conditions of the Exchange for resumption of trading. It is likely that trading in Mobio’s shares may not resume prior to the completion of the Transaction.

Completion of the Transaction is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable, disinterested shareholder approval. Where applicable, the Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Transaction will be completed as proposed or at all. Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Mobio Technologies Inc. should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed Transaction and has neither approved nor disapproved the contents of this news release.

For additional information please contact:

Laurie Baggio, CEO Tel: 604-805-7498 [email protected]

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Other than statements of historical fact, all statements included in this news release, including, without limitation, statements regarding future plans and objectives of Mobio are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Factors that could cause actual results to differ materially from those expected by Mobio are those risks described herein and from time to time, in the filings made by Mobio with Canadian securities regulators. Those filings can be found on the Internet at: http://www.sedar.com under the profiles of Mobio.

Neither the TSX Venture Exchange nor its Regulatory Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2022 TheNewswire – All rights reserved.