Vancouver, British Columbia – TheNewswire – August 29, 2022 – Smartset Services Inc. (TSXV:SMAR.P) (“Smartset” or the “Company”) Smartset, a “Capital Pool Company”, as defined under the policies of the TSX Venture Exchange (the “TSXV”), is very pleased to announce that, pursuant to the previously announced letter agreement (see press releases from June 17, 2021 and July 13, 2021) to combine Smartset, Great Southern Gold Corp. (“GSG”), and certain assets of GBM Resources Ltd (ASX:GBZ “GBM”), Smartset and GBM have entered into a definitive agreement (the “Definitive Agreement”) setting out the terms and conditions related to closing of the previously announced transaction (the “Proposed Transaction”) between Smartset and GBM. Further, the Company is pleased to announce that the management of GSG has approved the Share Purchase Agreement (“SPA”) and that the required GSG Shareholder approval is expected imminently.

Definitive Agreement between GBM and Smartset

The Definitive Agreement executed between GBM and Smartset sets out the terms and conditions by which certain mineral exploration tenements will be transferred to Smartset on closing of the Proposed Transaction. Under the terms of the agreement Smartset will acquire 100% of the exploration and mining rights for the Mt Morgan Project claims located in Queensland, Australia from GBM;

Pursuant to the terms of the agreement, the Proposed Transaction will see the Company acquire the Mt Morgan claims (the “Mt Morgan Claims”), comprised of over 975 square kilometers of exploration and mining claims surrounding the world class historic Mt Morgan gold and copper mine, from GBM an Australian Stock Exchange listed (ASX:GBZ) gold – copper producer and explorer. The Proposed Transaction is subject to a number of conditions precedent including, obtaining TSXV approval, and other Ministerial and related Government Agency approvals.

Share Purchase Agreement between GSG and Smartset

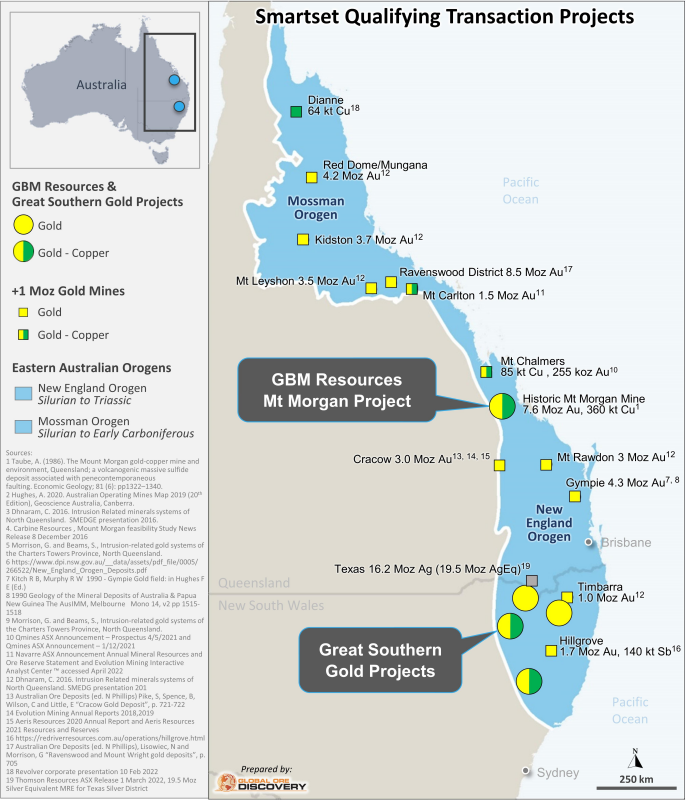

In accordance with the previously announced binding letter of intent among the Company, GBM and GSG, the draft SPA sets out the terms and conditions by which Smartset would acquire all of the issued and outstanding shares of GSG, a private British Columbia company, which owns the exploration rights to Bingara, Nundle, Bonalbo and Klondyke projects and other exploration tenement applications, located in New South Wales, Australia (together with the acquisition of the Mt. Morgan Claims, the Proposed Transaction). See Figure 1 for the location of the Qualifying Transaction Properties.

The Proposed Transaction is subject to a number of conditions precedent including, TSXV approval and shareholder approval from GSG.

Closing of the Proposed Transaction

As previously disclosed in Smartset’s June 17, 2021 news release, completion of the overall Proposed Transaction will result in the consolidation of Smartset and GSG to form a post-consolidation company which will own the Mount Morgan Project and the GSG assets. We note that Smartset has taken delivery from GBM and GSG of satisfactory National Instrument 43-101 technical reports in respect of the Mt Morgan Project and the Bingara project of GSG (the “Technical Reports”).

It is anticipated that upon successful completion of the Proposed Transaction, Smartset (the “Resulting Issuer”) will be listed on the TSXV as a Tier 2 mining issuer.

Highlights

The Proposed Transaction will consolidate under the Smartset banner a portfolio of five highly prospective district scale gold and copper exploration stage projects located in pro-mining states in Eastern Australia.

The Proposed Transaction is 100% share based with Smartset proposing to:

-

Consolidate its issued share capital at a ratio of 0.75:1.0

-

Issue an aggregate of 20,459,545 new shares to GBM (increased from 20,079,545 news shares under previously disclosed terms) to acquire 100% of the exploration and mining rights of the Mt Morgan Claims group that surround the historic, world class Mt Morgan mine that has produced over 7.6 M oz gold and 360,000 tonnes of copper

-

Issue approximately 11,625,000 new shares (increased from 10,568,182 news shares under previously disclosed terms) (the “GSG Shares”) to acquire 100% of the issued and outstanding shares of GSG, which owns 100% of the exploration rights to 4 district scale historic gold and copper projects, with significant historic production of alluvial and hard rock gold (the “GSG Properties”).

-

Have approximately 42,000,000 issued and outstanding common shares upon closing, prior to giving effect to the proposed concurrent financing discussed below (the “Proposed Financing”).

-

Upon completion of the Proposed Transaction, but prior to giving effect to the Proposed Financing, it is anticipated that the resulting merged company will be 27.5% owned by existing Smartset shareholders, 47.5 % owned by GBM and 25.0 % owned by GSG shareholders.

-

In connection with the Proposed Transaction, Smartset plans to raise C$8 Million to advance the exploration of the Projects and operate the Company following closing. Nearer term exploration plans include data compilation and integrated desktop analysis to leverage extensive historic stream sediment, rock chip and soil data, with the goal of prioritizing areas for state of the art regional airborne magnetic and electromagnetic (EM) geophysical surveys over the most prospective tenement areas.

Note: Final share exchange ratios and shares issued to the respective issuers may vary pending Proposed Transaction closing to reflect the then current capitalization of the issuers at the time of close.

Comment:

Smartset’s Director Mr. Karabelas stated: “We are extremely pleased to be announcing the execution of the Definitive Agreement between Smartset and GBM and the imminent execution of the SPA with GSG. Our sincere hope is that combining this wonderful set of assets under the Smartset banner, with an exceptional management team, Board of Directors and Technical Advisory group, and access to the expertise and mineral focus of the Canadian capital markets, places the Company on the path to great discoveries of gold, copper and other minerals. We look forward to the close of the Proposed Transaction in the months to come.”

Summary of Proposed Transaction

As previously disclosed, pursuant to the Proposed Transaction, Smartset will acquire 100% of the exploration and mining rights for the Mt Morgan Claims located in Queensland, Australia from GBM; and would acquire all of the issued and outstanding shares of GSG, a private British Columbia company, which owns the exploration rights to the of the Bingara, Nundle, Bonalbo and Klondyke projects located in New South Wales, Australia. Please see Smartset’s news release of June 17, 2021 for the full details regarding the Proposed Transaction and the Mt. Morgan Project.

As previously disclosed, the Proposed Transaction is subject to a number of conditions precedent including TSXV approval, and shareholder approval from both GSG and GBM if required under applicable corporate law. The Company, GBM and GSG are continuing to work together to complete the filings and submissions required to obtain TSXV acceptance of the Proposed Transaction.

All of the securities to be issued in connection with the Proposed Transaction, other than the GSG Shares, will be subject to a hold period of four months and one day. The GSG Shares will be free of any statutory hold periods. Trading in the common shares of the Company has been halted in connection with the announcement of the Proposed Transaction. The Company expects that trading will remain halted pending closing of the Proposed Transaction, subject to the earlier resumption upon TSXV acceptance of the Proposed Transaction and the filing of required materials in accordance with TSXV policies.

The Mt Morgan Project

The Proposed Transaction is structured such that Smartset will acquire 100% of the Mt. Morgan group of tenements from GBM. The Company’s consolidated Mt. Morgan project will comprise over 975 square kilometers of contiguous tenements around the past producing Mt Morgan gold & copper mine. The Mt. Morgan mine historically produced in excess of 7.6 million ounces of gold and 360 kilotonnes of copper1 over the span of almost 100 years. Smartset’s intended strategy is to take an integrated district scale approach to exploring for concealed Mt. Morgan style mineralization at the project. The Company plans to acquire new regional scale magnetics, radiometrics and airborne electrical geophysics data and to integrate this with the extensive historic geochemical datasets and leading-edge deposit models to systematically explore this large prospective property package.

The GSG Project Portfolio

The Proposed Transaction is structured such that Smartset will acquire 100% of GSG on closing. GSG owns 100% of four gold and copper projects, Bingara, Nundle, Bonalbo and Klondyke, that cover over 1200 square kilometers of claims as well as applications for exploration tenements that cover a further 1,890 square kilometers of claims. The portfolio encompasses a series of significant historic mother lode and intrusion related gold fields and high-grade VMS copper-gold mines that were worked from the 1860’s to 1940’s in New South Wales, Australia. The most advanced project in the portfolio is Bingara, that encompasses 100% of the +25 km long group of historic hard rock and alluvial gold workings hosted by crustal scale suture zone, the Great Serpentinite Belt (GSB)2,3. The Bingara project is considered to be prospective for Mother Lode Style orogenic gold, VMS copper and intrusion related Ni-Cu3,4,5,6. The company plans to undertake a systematic program of cutting edge exploration on this large consolidated group of tenements.

On behalf of SMARTSET SERVICES INC.

“Randy Clifford”

Chief Executive Officer

Phone:(778) 362-3037

Email: [email protected]

Figure 1: Qualifying Transaction Projects

Stephen Nano, has approved the technical content in its form and content of this news release. Mr. Nano Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM) and is a Qualified Person under NI 43 -101. Mr. Nano is an advisor to GBM Resources and Smartset Services and a Director of Great Southern Gold Corp and owns shares in these companies.

Assay results from channel, trench, and drill core samples may be higher, lower or similar to results obtained from surface samples due to surficial oxidation and enrichment processes or due to natural geological grade variations in the primary mineralization.

Completion of the Proposed Transaction is subject to a number of conditions, including but not limited to, TSXV acceptance and if applicable pursuant to TSXV requirements, shareholder approval. Where applicable, the Proposed Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Proposed Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Proposed Transaction, any information released or received with respect to the Proposed Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSXV has in no way passed upon the merits of the Proposed Transaction and has neither approved nor disapproved the contents of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding: the terms, conditions, and completion of the Proposed Transaction, the definitive agreement and the proposed concurrent financing; the business and operations of the Resulting Issuer upon completion of the Proposed Transaction; regulatory approvals and use of funds. In making the forward- looking statements contained in this press release, the Company has made certain assumptions, including that: due diligence will be satisfactory; the concurrent financing will be completed on acceptable terms; all applicable corporate, shareholder, and regulatory approvals for the Proposed Transaction will be received; and there would not be changes in the conditions under which the Proposed Transaction would complete, including regulatory changes or the operating environment for the Resulting Issuer upon completion of the Proposed Transaction. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: results of due diligence; availability of financing; delay or failure to receive board, shareholder or regulatory approvals; and general business, economic, competitive, political and social uncertainties and economic risks associated with current unprecedented market and economic circumstances due to the COVID-19 pandemic. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

UNITED STATES ADVISORY. The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), have been offered and sold outside the United States to eligible investors pursuant to Regulation S promulgated under the U.S. Securities Act, and may not be offered, sold, or resold in the United States or to, or for the account of or benefit of, a U.S. Person (as such term is defined in Regulation S under the United States Securities Act) unless the securities are registered under the U.S. Securities Act, or an exemption from the registration requirements of the U.S. Securities Act is available. Hedging transactions involving the securities must not be conducted unless in accordance with the U.S. Securities Act. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in the state in the United States in which such offer, solicitation or sale would be unlawful.

Sources:

-

Taube, A., 1986. The Mount Morgan gold-copper mine and environment, Queensland; a volcanogenic massive sulfide deposit associated with penecontemporaneous faulting. Economic Geology 1986; 81 (6): 1322–1340. doi: https://doi.org/10.2113/gsecongeo.81.6.1322

-

Fergusson, CL, 2019. Subduction accretion and orocline development in modern and ancient settings: Implications of Japanese examples for development of the New England Orogen of eastern Australia. Journal of Geodynamics, 129, 117-130.

-

Ashley, PM and Flood, PG, 1997. Tectonics and metallogenesis of the New England orogen. Geological Society of Australia.

-

Brown, RE, Krynen, JP and Brownlow, JW, 1992. Metallogenic Study and Mineral Deposit Data Sheets Manilla-Narrabri 1:250,000 Metallogenic Map SH/56-9, SH/5555-12. Geol. Survey of New South Wales, Sydney. 319 pages.

-

Brown, RE, 1995. Mineral Deposits of the Bingara, Croppa Creek, Gravesend and Yallaroi 1:100 000 sheet areas. Quarterly notes 98. Geological Survey of New South Wales, Sydney.

-

Brown, RE and Stroud, WJ, 1997. Inverell 1:250 000 Metallogenic Map SH/56-5: Metallogenic Study and Mineral Deposit Data Sheets. Geological Survey of New South Wales, Sydney, viii + 576 pp.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF U.S. SECURITIES LAWS.

Copyright (c) 2022 TheNewswire – All rights reserved.